Automated Algorithmic Trading with Intelligent Execution

- Started

- 1st September 2012

- Ended

- 28th December 2012

- Research Team

- Ash Booth

- Investigators

- Frank McGroarty, Enrico Gerding

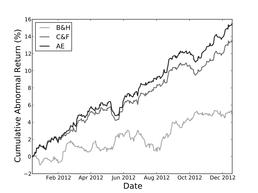

Results from a single experimental run showing the cumulative abnormal return (CAR) of our Adaptive Execution (AE) strategy compared to benchmarks.

Our trading agent uses techniques based on extensions of Adaptive Aggressiveness and Creamer and Freund’s boosting prediction algorithms. We find that, on top of addressing the unrealistic assumptions of previous strategies, our algorithm, on average, accounted for a 46% increase in profitability compared to the state of the art.

Categories

Algorithms and computational methods: Agents, Classification, Machine learning, statistical analysis

Visualisation and data handling software: Pylab

Software Engineering Tools: Eclipse

Programming languages and libraries: C++, Python, R

Transdisciplinary tags: Complex Systems, Computer Science, Economics