Automated Trading with Performance Weighted Random Forests and Seasonality

- Started

- 7th January 2013

- Ended

- 5th September 2014

- Research Team

- Ash Booth

- Investigators

- Frank McGroarty, Enrico Gerding

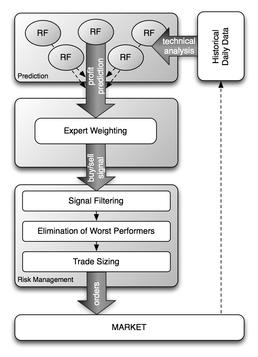

Seasonality effects and empirical regularities in financial data have been well documented in the financial economics literature for over seven decades. This project proposes an expert system that uses novel machine learning techniques to predict the price return over these seasonal events, and then uses these predictions to develop a profitable trading strategy. While simple approaches to trading these regularities can prove profitable, such trading leads to potential large drawdowns (peak-to-trough decline of an investment measured as a percentage between the peak and the trough) in profit. In this project we introduce an automated trading system based on performance weighted ensembles of random forests that improves the profitability and stability of trading seasonality events. An analysis of various regression techniques is performed as well as an exploration of the merits of various techniques for expert weighting. The performance of the models is analysed using a large sample of stocks from the DAX. The results show that recency-weighted ensembles of random forests to produce superior results in terms of both profitability and prediction accuracy compared with other ensemble techniques. It is also found that using seasonality effects produces superior results than not having them modelled explicitly.

Categories

Algorithms and computational methods: Machine learning, Optimisation, statistical analysis

Visualisation and data handling software: Pylab

Software Engineering Tools: Eclipse

Programming languages and libraries: Python, R

Transdisciplinary tags: Complex Systems, Computer Science, Economics