Evolving Resilience to Leverage Based Crashes

- Started

- 1st July 2011

- Ended

- 30th September 2011

- Research Team

- Ash Booth

- Investigators

- Frank McGroarty, Enrico Gerding

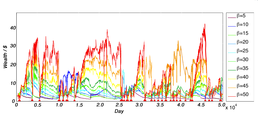

Time series of the wealth of hedge funds during a simulation run. Days during which a fund defaults are indicated by red triangles.

The model attempts to simulate agents' behaviour in more detail than previous work and allows us to see how excess leverage (borrowing funds for speculative investments) is a source of increased vulnerability and can act as a stimulus for crashes. The model illustrates how crashes come about as a consequence of synchronisation effects of the various agents in financial markets. The project concludes with recommendations for deeper exploration of risk management strategies using agent based modelling.

Categories

Socio-technological System simulation: Economic Networks, Social and Socio-economic Systems

Algorithms and computational methods: Agents

Programming languages and libraries: C++, R

Transdisciplinary tags: Complex Systems