Self Interest & the Evolutionary Optimisation of Adaptive Trading Agents for Continuous Double Auctions

- Started

- 10th September 2010

- Ended

- 30th June 2011

- Research Team

- Ash Booth

- Investigators

- Frank McGroarty, Enrico Gerding

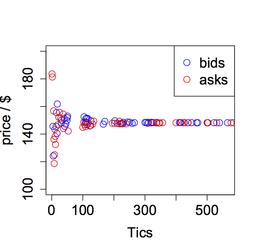

Bid and Offer prices from trading agents in a market consisting of traders optimised to minimise Smith’s alpha

One cannot escape the recent crises in economics and the lack of understanding of financial markets that has been highlighted by them. Improvements to current market models are already being made and a realisation of the power of agent based modelling in such models is evident. In this project we seek to explore an existing model by Cliff of trader behaviour in continuous double auctions. We investigate the strategies that arise in such auctions when trader parameters are evolved with intent to maximise personal profit. Results show different trading strategies to those evolved by Cliff and explanations are given with regards to the self-interest.

Categories

Socio-technological System simulation: Social and Socio-economic Systems

Algorithms and computational methods: Agents, Evolutionary Algorithms

Programming languages and libraries: C++

Transdisciplinary tags: Complex Systems, Economics