It takes all sorts: the mathematics of people’s behaviour in financial markets

- Started

- 1st October 2014

- Ended

- 2nd October 2017

- Research Team

- Frank McGroarty, Enrico Gerding

- Investigators

- Valerio Restocchi

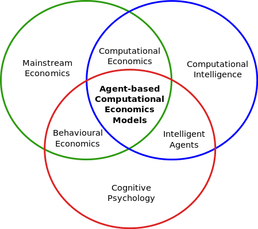

Agent-based computational economics (ACE) [source: Turing Finance http://www.turingfinance.com/agent-based-computational-economic-models/]

Do we all behave the same way, and only make perfectly rational choices? Definitely not. Yet, these are common assumptions in finance. But financial markets are driven by human beings, each with unique characteristics and behaviours, and neglecting this heterogeneity results in missing the complex dynamics generated by human interactions.

We use mathematics to model how people behave in financial markets, including their ‘misbehaviours’ such as extreme risk appetites, misinterpretation of information, or greed. Financial markets are complex systems and, as such, they are almost impossible to model in their full complexity. However, by modelling each market participant we can run more realistic simulations of financial markets, and study the emerging patterns that these behaviours generate.

However, these simulations require a computational power which is far beyond the capability of normal computers. Iridis allows us to reduce the running time of our simulations from years to hours, and to effectively run our simulations without reducing their complexity. Once we understand how people really behave in financial markets, it will be possible to forecast market crashes and financial crises, consequently preventing them or, at least, mitigating their aftermath. Thanks to agent-based models and supercomputers such as Iridis, we are a step closer to this.

Categories

Socio-technological System simulation: Social and Socio-economic Systems

Algorithms and computational methods: Agent-Based Negotiation, Agents, Monte Carlo

Visualisation and data handling software: Pylab

Programming languages and libraries: Mathematica, Python

Computational platforms: Iridis, Mac OS X

Transdisciplinary tags: Complex Systems, Computational Social Science, Economics