The Role of Information in Price Discovery

- Started

- 5th October 2009

- Ended

- 31st May 2010

- Research Team

- Camillia Zedan

- Investigators

- Antonella Ianni, Seth Bullock

The recent economic crisis has highlighted a continued vulnerability and lack of understanding in the financial markets. In order to overcome this, many believe that current market models must be improved. Recently, a trend towards agent-based modelling has emerged. Viewing the economy as a complex system is beginning to be seen as key to explaining certain market characteristics that were originally considered anomalies.

One of the fundamental assumptions in economics is that of information efficiency: that the price of a stock reflects its worth, that all possible information about a security is publicly known, and that any changes to price take place instantaneously. In reality, however, this is not the case.

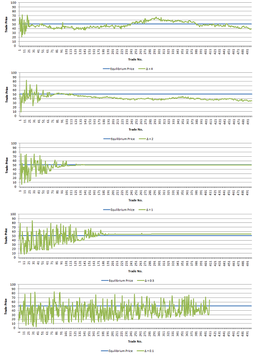

This project considers the use of agents in modelling economic systems and demonstrates the effect of information levels on price discovery using a simple market simulation.

Categories

Socio-technological System simulation: Social and Socio-economic Systems, Social Networks

Algorithms and computational methods: Agents, Game Theory

Software Engineering Tools: Eclipse

Programming languages and libraries: Java

Computational platforms: Windows

Transdisciplinary tags: Complex Systems, Computer Science, Design, Scientific Computing, Software Engineering